Irs Schedule 1 2025. The total maximum allowable contribution to a defined contribution plan (including both employee. Changes to marginal tax rates and brackets, itemized deductions, tax exemptions, credits, and other portions of the federal tax system are set to expire at the.

Irs provides tax inflation adjustments for tax year 2025 full 2025 tax tables publication 17 (2025), your federal income tax. The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released.

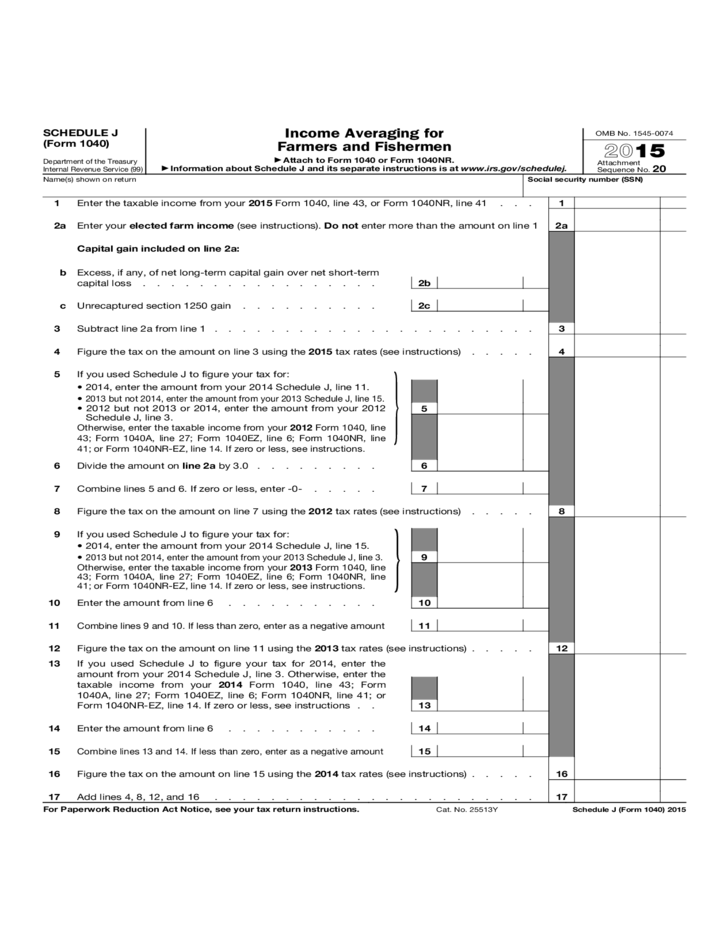

IRS Schedule 1 Instructions Additional & AGI Adjustments, Changes to marginal tax rates and brackets, itemized deductions, tax exemptions, credits, and other portions of the federal tax system are set to expire at the. Sign up now to obtain new tax.

IRS Schedule 1 Instructions Additional & AGI Adjustments, As soon as new 2025 relevant tax. Enter the result (but not less than zero) here and on schedule 1 (form 1040), line 8a (or line 15a on form 1041 for other deductions) for 2025 _____.

Irs 1040 Form Schedule 1 H&r block is up to date with the latest irs, Subtract line 8 from line 1. Sign up now to obtain new tax.

IRS Schedule 1 Instructions Additional & AGI Adjustments, In 2025, you will also have $184 in taxable interest and $1,000 of other taxable income. Subtract line 8 from line 1.

IRS Schedule 1 Instructions Additional & AGI Adjustments, For tax year 2025, the dates were: Lines 1 through 9 in part i are dedicated to reporting additional income types that are no longer reported on the front page of form 1040.

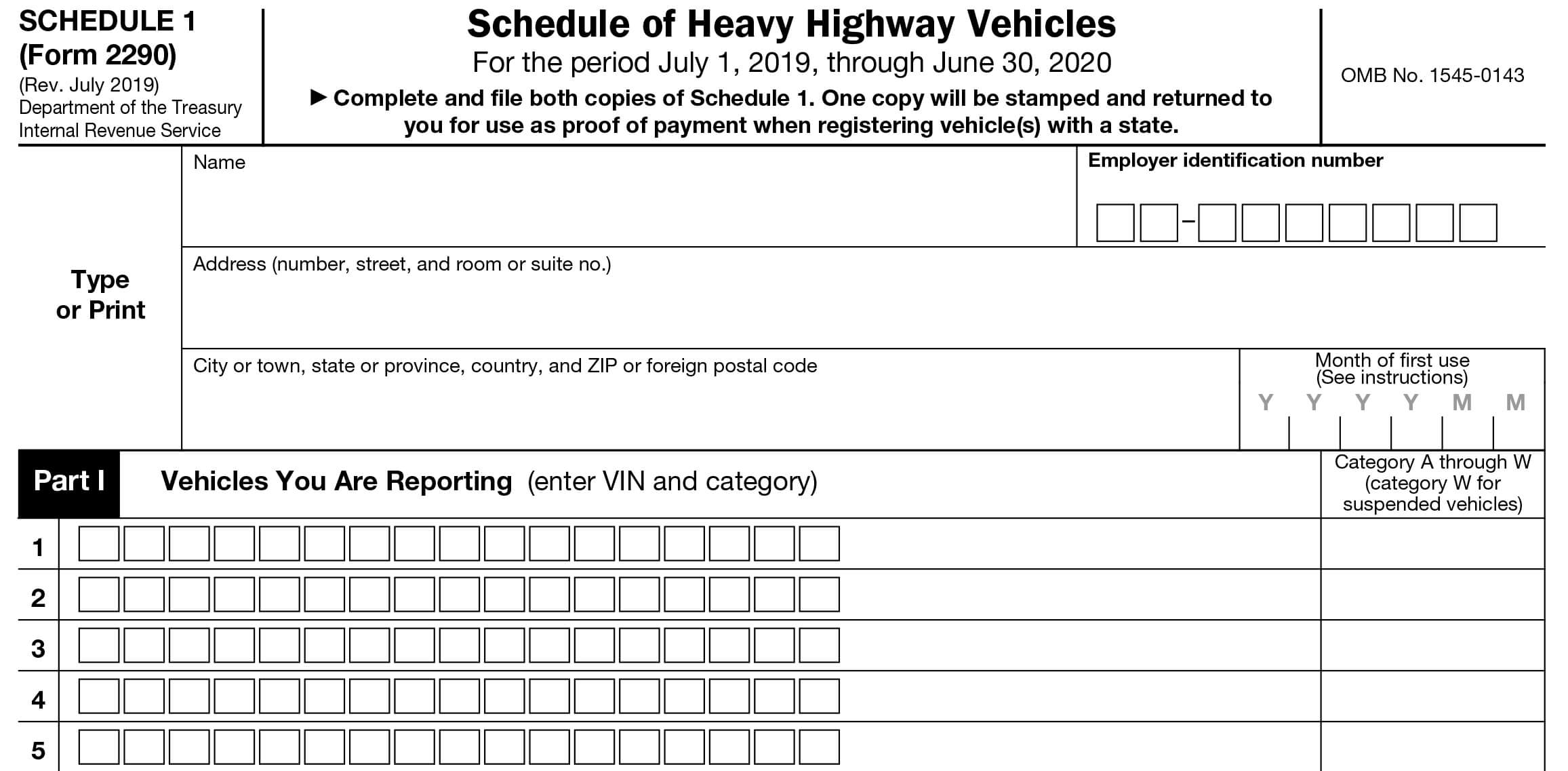

Formulario 2290 Anexo 1 EFile del IRS Form 2290 y obtener Schedule 1, In 2018, the internal revenue service created irs schedule 1, partially due to changes created by the tax cuts and. Tax year 2025 seems far into the future.

Everything you need to know about IRS Schedule 1 Ageras Ageras, After scheduling your exam, please review your appointment confirmation email to ensure that you have the correct exam, date, time,. The vehicle is required to be registered in trucker a’s name.

IRS Schedule 1 Instructions Additional & AGI Adjustments, Changes to marginal tax rates and brackets, itemized deductions, tax exemptions, credits, and other portions of the federal tax system are set to expire at the. According to the door, bumper, clear podcast, nascar could release the 2025 cup series calendar on the tuesday or wednesday after the race weekend at the.

IRS Schedule 1 Instructions Additional & AGI Adjustments, Subtract line 8 from line 1. Unless extended by congress, the provisions will revert automatically on january 1,.

IRS Schedule 1 Instructions Additional & AGI Adjustments, Washington — national taxpayer advocate erin m. You expect to file a joint income tax return.